By Ann-Marie Stagg, Chief Executive of the Call Centre Management Association

The world is becoming increasingly intertwined with technology, creating challenges within call centre authentication processes. As we dive into the era of machine learning, artificial intelligence, and deep learning, our authentication solutions should too. The connected world is sparking the end of KBAs – or knowledge based authentication questions, which have been identified as the most common authentication solution.

Earlier this month, during the Phone Fraud Insurance Sector Workshop held in the UK, the CCMA facilitated a questionnaire outlining current authentication tactics, information gained through the phone channel, enterprise priorities in regard to fraud, and more.

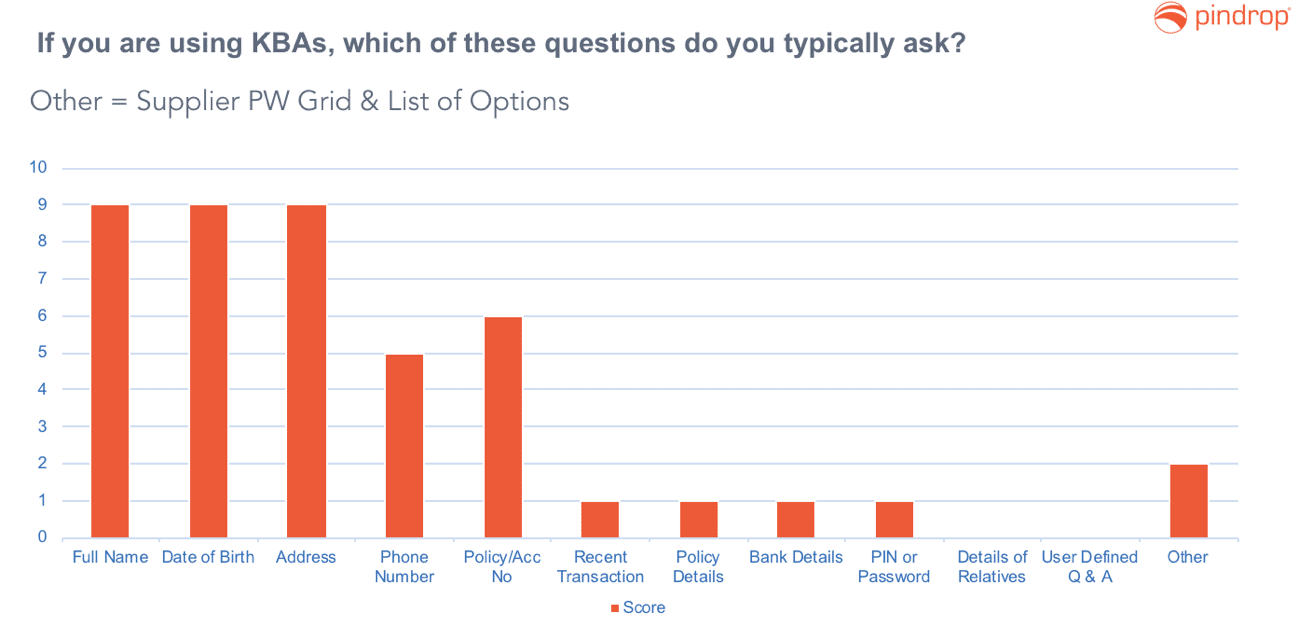

When inquiring about current authentication procedures, 100% of those surveyed currently authenticate customers via KBA, asking three or more questions.

However, the rise in readily available data found online or through the black market allows fraudsters to easily navigate KBA within the phone channel. Additionally, these questions negatively impact overall customer experience due to additional time spent and ease of fraudulent acceptance. According to Gartner, 10-30% of customers are not able to remember their own KBAs and are not able to successfully authenticate the first time.

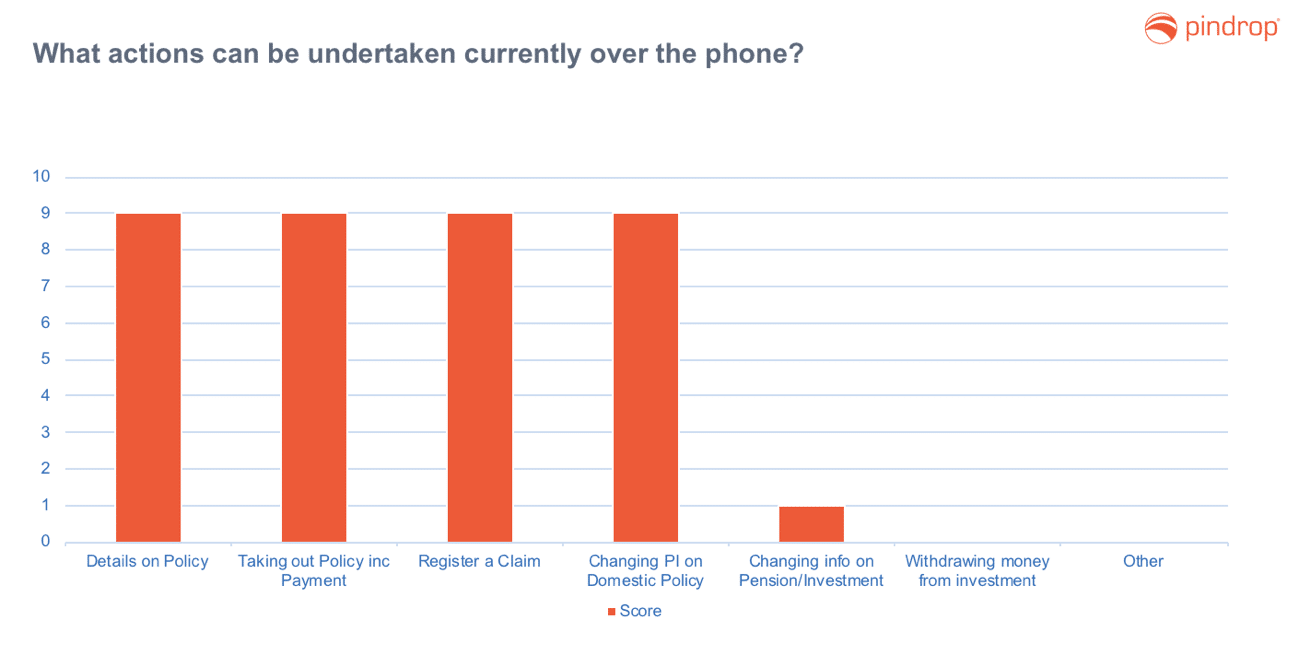

The majority of respondents stated they are experiencing a fairly stable rate of customers contacting their enterprises via the phone channel, making authentication within the call centre an ongoing priority. If the caller is authenticated, respondents offered various actions to be undertaken over the phone – if spoofed and undetected, fraudsters would have equal access to the following customer information:

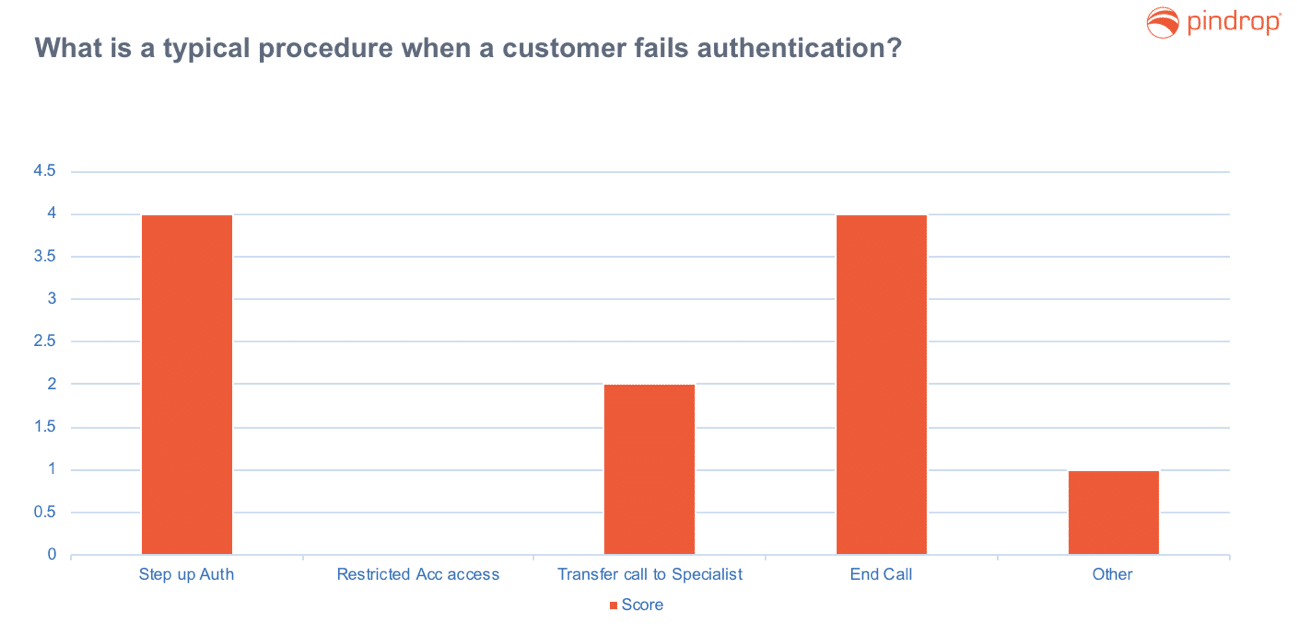

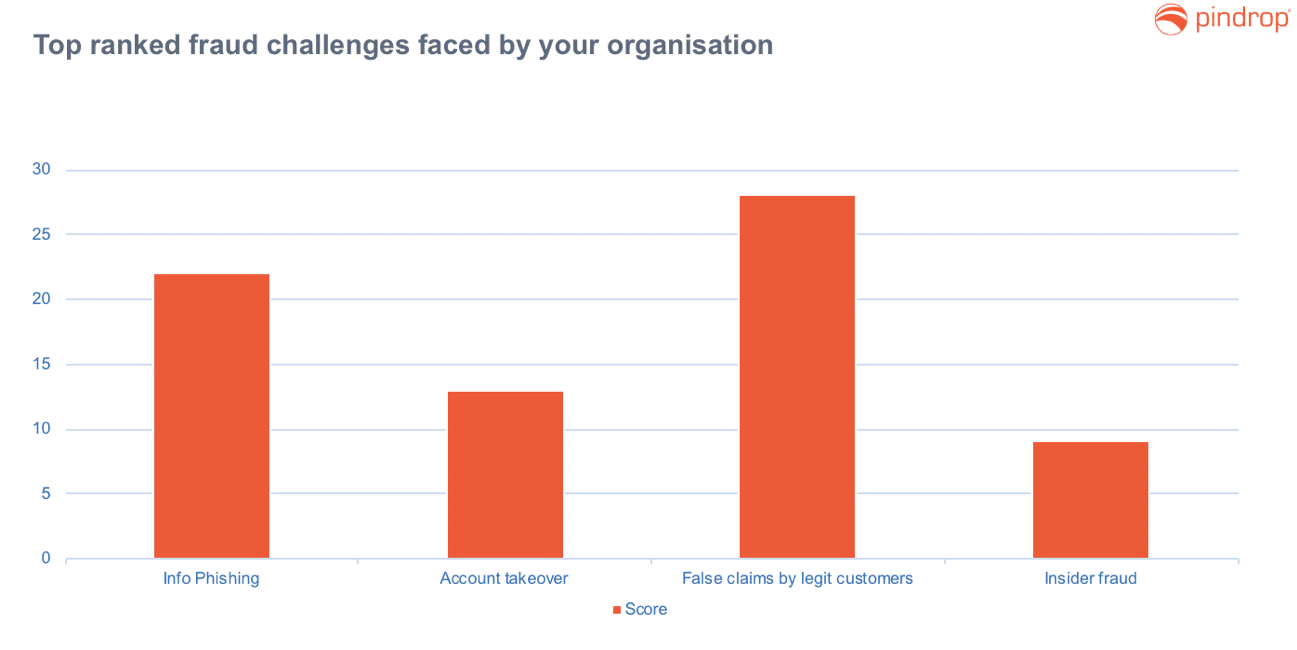

These shocking statistics are telling us that fraudsters are typically able to authenticate better than our legitimate customers. The exposed call centre is enabling more fraud than what most organisations anticipate, as it impacts not only the phone channel but transforms into an omnichannel problem. According to Shirley Inscoe of Aite Group, 61% of cross-channel fraud originates in the call centre. From false claims to phishing, fraudsters attempt to maneuver around security measures in efforts to gain financially.

The online channel was identified as the top priority of fraud prevention, with the phone channel following behind in second place, and the branch channel in third. Disregarding the channel involved, the attendees identified top priorities their organisation has around fraud, entailing both visible and hidden costs.

Fraudsters are able to easily bypass KBAs and other legacy solutions by taking advantage of readily available personal identifying information found via social media or the black market. Additionally, KBAs often extend call times, offering a less than positive customer experience. Enterprises are faced with the challenge of creating a balance between preventing fraud while ensuring a positive customer experience.

According to the overall survey results, enterprises are not understanding the impact fraud is having on their phone channels. It is clear legacy authentication solutions are not implementing the level of security necessary to not only protect the call centre and the unified commerce, but provide frictionless customer experiences. If top priorities are superior customer service and prevention of fraud loss, the question then becomes – how will you solve for both?

Contact us for more information.