Articles

How Monitoring Your IVR Helps Predict + Reduce Fraud

Pindrop

author • 23rd June 2020 (UPDATED ON 01/17/2025)

4 minute read time

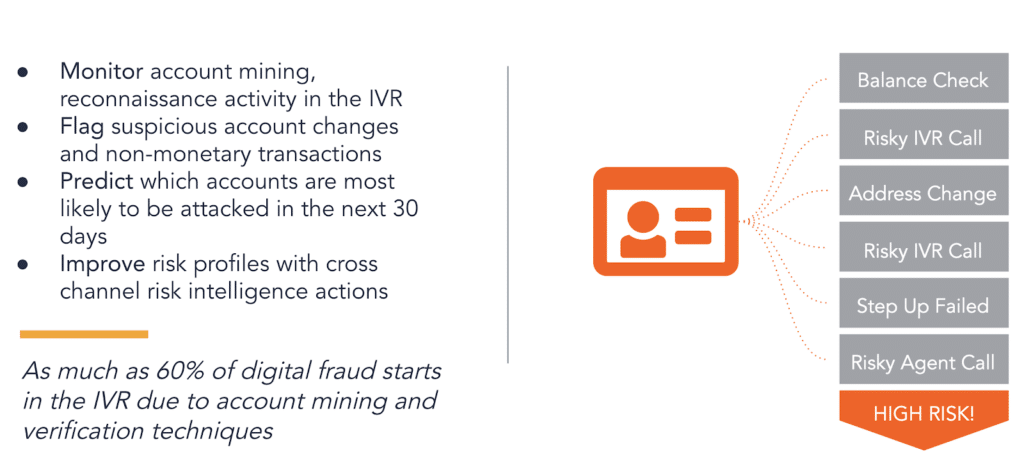

Fraudulent activity in the IVR has become a tool for more sophisticated fraudsters and scammers to gain sensitive data that puts contact centers and financial institutions at risk.

Fraudsters often use IVR systems to mine and validate information, which they subsequently leverage to commit fraud at various other touchpoints downstream. As fraud tactics evolve to adapt to the changing landscape in which businesses are operating, sophisticated technology solutions can help contact centers proactively address fraud. Monitoring your IVR is an integral step in this process.

What is IVR Fraud, and Why Should I Focus Here?

IVR Fraud is defined as fraudulent activity or activities leading to fraudulent activity that occurs within an interactive voice response system, or IVR. Fraudsters exploit IVRs to surveil accounts and to operationalize their fraud and planning tactics.

Low monitoring rates in the IVR has allowed fraudsters to build up formidable attacks by first mining and validating customer information and then using the verified data to execute social engineering attacks against customer service agents or fraudulent activity across other channels like chat and email. Highly trained and organized, professional fraudsters can manipulate even seasoned agents into taking over accounts.

Employing software capable of leveraging all data in the call lifecycle, even the non-audio data from within an IVR, can help identify:

- Suspicious behavior that could be mining or validation

- At-risk accounts across communication channels

- High-risk callers before they are ever connected to an agent.

In practice, the experience for the customer, agent, and the leadership team of contact centers will significantly depend on the strategies and technology they adopt. Pindrop Protect, for example, is entirely passive – working in the background throughout the entire call to monitor each call and associated account event for anomalies that could lead to fraud downstream.

How to Detect and Combat Fraud in the IVR

Detecting fraud in the IVR helps ward off fraudsters pretending to be legitimate agents. Millions of calls flow through the IVR, and far fewer of these calls ever reach an agent. Contact centers can employ strategies and best practices to operationalize intelligence from their IVR systems to predict, identify, and address fraud in the phone and across other channels. .

3 Benefits of Fighting Fraud in The IVR- Beyond Cost Savings/

- An extra layer of protection before connecting to an agent

Customer service agents are easily socially engineered by experienced fraudsters. Leveraging fraud monitoring and identification practices within the IVR give agents a powerful tool that empowers agents to protect customer data. By assessing calls before they are connected to agents for suspicious activity, past behavior, or account

- IVR insights predict fraud outside of the phone channel

Protect clients can provide real-time risk updates for customer accounts, letting them know which accounts are seeing fraudulent or fraud supporting activities in real-time. Our proprietary technology combined with our AI predicts which account are most likely be attacked next – while simultaneously calculating a risk per call and caller. Machine learning ingests caller behavior- like address changes, keypresses, and metadata from the call – even if performed in the IVR to assess the likelihood of fraud.

- A simplified way to identify at-risk accounts

Anti-fraud clients like Protect provide real-time risk updates for customer accounts, alerting teams to at-risk accounts. Protect calculates call and account risk at the beginning and at the conclusion of each call, leveraging the entire call lifecycle from connection to an IVR to the conclusion of the call.

In short, leveraging call data from the full lifecycle of the call, including non-audio metadata from IVR, helps harden your organization to customer data theft, protecting your brand on the phone channel and across all others where you interact with customers.

Pindrop Protect is a multifactor anti-fraud detection service that enables fraud teams to stop fraud in real-time, predict future fraudulent activity, reduce fraud-related costs, improve efficiency & review rates, and harden the contact center to attack. Unlike other solutions, Protect works from IVR to agent identifying which calls are risky, and flagging accounts that are likely to be attacked up to 30 days before an attack can occur. Our solution is also more accurate, detecting up to 80% of phone channel fraud, even on the first attempt, and helps prevent fraud across channels, helping to secure customer data and your revenue beyond the contact center.