How Pindrop and Boost.ai unite to drive secure and efficient experiences for DFCU’s member base

How passive authentication can protect your business, reduce average call handle time, increase IVR containment and improve contact center customer experience

The future of authentication

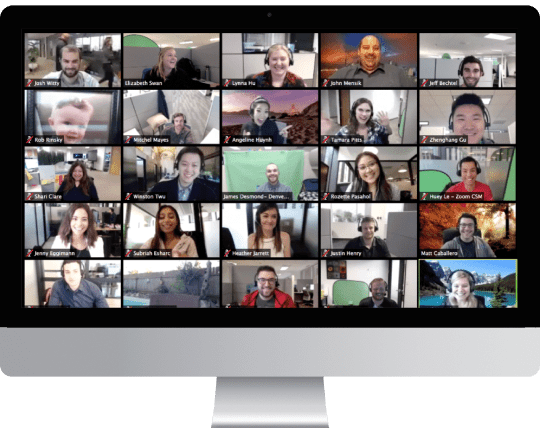

Your expert panel

Hailey Crundwell

Sales Leader, Pindrop

Chase Tarkenton

SVP & General Manager, NA, Boost.ai

Sara Candelaria

Assistant Vice President, Desert Financial Credit Union

David Tevendale

Manager, Partner Programs, Pindrop